We take investing your charitable dollars seriously. WCF works in step with our locally based Investment Committee and our national consultant, the Atlanta Consulting Group. Together, we have devised a pool of investment options and strategies for different levels of risk tolerance and investment time horizons, making sure we meet your charitable objectives.

Each pool of funds that we offer is tailored to suit a specific investment strategy. Our fund establishment advisors will counsel you to choose a fund that appropriately reflects the integrity of your legacy.

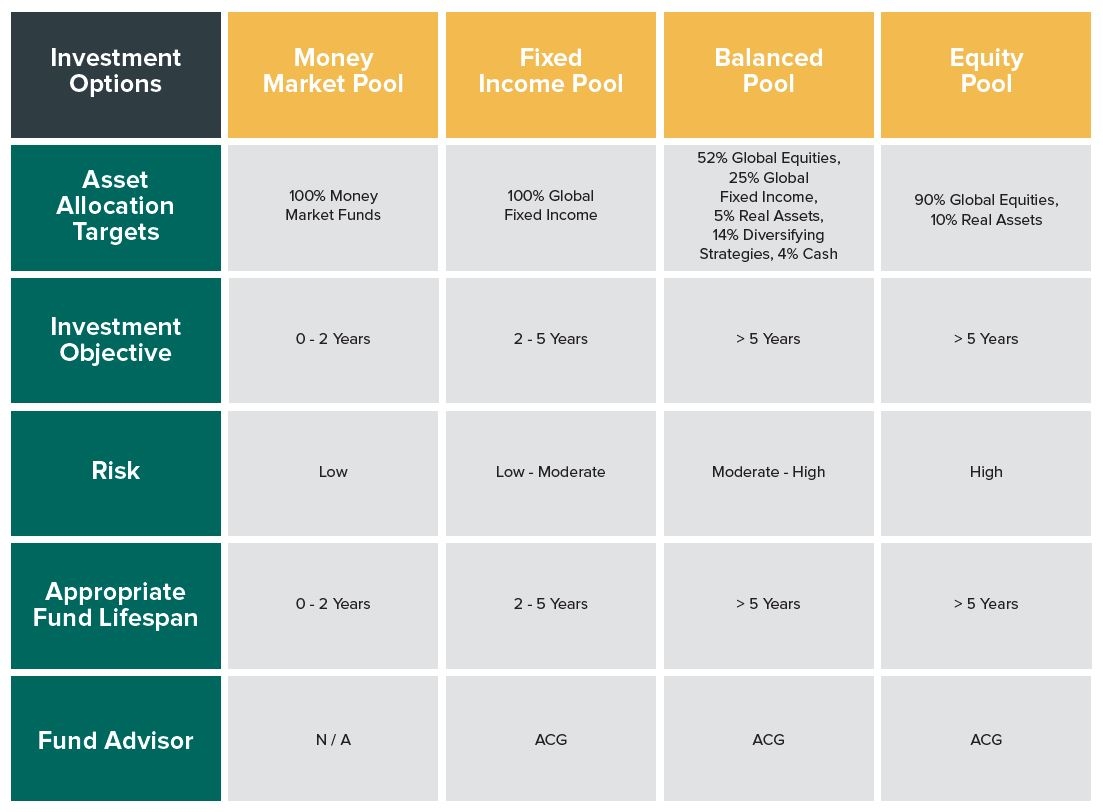

| Investment Options | Money Market Pool | Fixed Income Pool | Balanced Pool | Equity Pool |

|---|---|---|---|---|

| Asset Allocation Targets | 100% Money Market Funds | 100% Global Fixed Income | 52% Global Equities, 25% Global Fixed Income, 5% Real Assets, 14% Diversifying Strategies, 4% Cash | 90% Global Equities, 10% Real Assets |

| Investment Objective | 0 - 2 Years | 2 - 5 Years | > 5 Years | > 5 Years |

| Risk | Low | Low - Moderate | Moderate - High | High |

| Appropriate Fund Lifespan | 0 - 2 Years | 2 - 5 Years | > 5 Years | > 5 Years |

| Fund Advisor | N / A | ACG | ACG | ACG |

Please review our spending policy for specific details about the Foundation’s portfolio, oversight and more. The Board may amend this Policy at any time, and the Policy, as so amended, shall then apply to all endowment Funds, whether created before or after such amendment. This Policy shall apply to endowment Funds existing on July 1, 2008, as well as to Funds thereafter created.

View our Financial Information

Review our investment summary and financial statements for an overview of the Foundation’s stewardship of community funds.

For all financial requests, please contact our Director of Accounting.